40 coupon vs zero coupon bonds

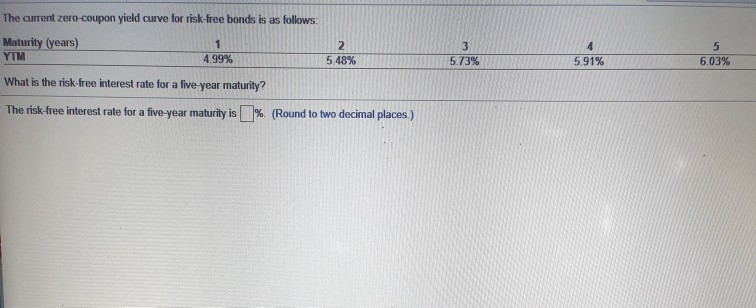

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Zero-Coupon Bond. In earlier days, companies used to raise funds from investors based on a written guarantee. This written guarantee is known as a bond. Coupon bonds provide coupons or interests at regular intervals. Zero-Coupon Bonds, as the name suggests, do not provide any coupon or interest during the tenure but repay the face value at the ... The Zero Coupon Bond: Pricing and Charactertistics This means if we pay something around $72 (100-28) on December 1, 1996 for the $100 coupon due on December 1, 2001, we will earn something around 30% over the period or 6% a year. Pulling out our trusty bond calculator, we can actually do the calculation. At a semi-annual yield of 5.6%, the price works out to be $75.91.

Zero coupon bond calculator A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros- coupon bonds are ideal for long-term, targeted financial needs. An investor expects the current 1-year rate for a zero - coupon bond to remain at 6%, the 1-year rate next year to be 8%, and the 1-year rate in ...

Coupon vs zero coupon bonds

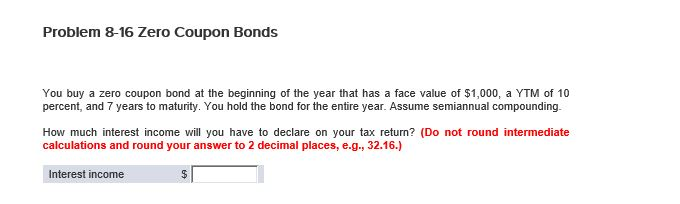

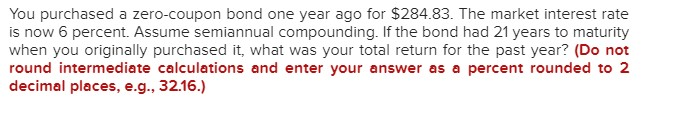

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ... Zero-Coupon Bond: Formula and Excel Calculator Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest that will be earned over the 10-year life ...

Coupon vs zero coupon bonds. What is the difference between a zero-coupon bond and a regular bond? A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. With a normal yield curve, long-term bonds have higher ... Deep Discount bonds and Zero Coupon Bonds - The Fixed Income A regular auction of T-Bills was started by the RBI in 1987. The issues are in the nature of Deep Discount Bonds (DDB). IDBI exercised its call in 2002, 10 years after the issue, and paid the investor Rs. 12,000 as advertised. (The investor earned just a little more than double every 5 years - a return of over 14% compounded annually. About Discount Bonds versus Zero Coupon Bonds Zero Coupon bonds are securities issued at a discount, and they have a zero coupon rate; they pay no interest. Zero Coupon bonds generally have a Maturity Date that is more than a year and a half out from the issue date. Unlike discount bonds, Zero Coupons do take compounding into account, and are generally issued with a semi-annual compounding ... Zero Coupon Bonds Explained (With Examples) - Fervent The only thing they do pay is the Par (aka "face value") when the bond matures. Put differently, a zero coupon bond is a bond that doesn't pay any interest. Instead, it only pays a lump-sum payment at the end of the bond's life. That is, at its maturity or expiration date; i.e., the date when the bond matures or expires.

Difference Between a Zero-Coupon CD & a Bond - The Nest Restrictions. One of the main differences between zero-coupon CDs and a bonds is in the way you buy and sell them. Although some financial services firms now offer CDs, traditionally you buy a CD directly from the issuing bank. If you sell the CD back to the bank before it matures, you will owe an interest penalty. What is a Zero Coupon Bond? Who Should Invest? | Scripbox Introduction. Zero coupon bonds are fixed income securities that don't pay any interest. At the time of maturity, the investor is paid the face value or par value. These bonds come with 10-15 years maturity.Hence, they trade at a deep discount. The bond pricing varies with time to maturity.. The higher the time until maturity, lower will be the price the investor will be willing to pay. Zero Coupon Bonds. Rogersville Corp. needs to raise | Chegg.com Expert Answer. Zero Coupon Bonds. Rogersville Corp. needs to raise fund and issues 20 -year zero coupon bond. If the face value of the bond is $23,500.00 and the current interest is 3.71%, how much is the bond? a. $13,490.24 b. $11,341.10 c. $1,132.97 d. $48,694.57 Zero Coupon Bonds. Rogersville Corp. needs to raise fund and issues 20 -year ... Pricing zero-coupon CAT bonds using the enlargement of ltration theory ... We obtain some closed-form prices of zero-coupon CAT bonds in Model 2 so we give a numerical illustrative example for this latter. Discover the world's research. 20+ million members;

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Updated. Jul 28, 2022, 9:13 AM. Buying zero-coupon bonds can be a good deal for ... What is the difference between a zero-coupon bond and a regular ... - Quora Answer (1 of 6): Hello, The difference between a regular bond and a zero-coupon bonds, is that the former pays bondholders interest, while the latter does not issue such interest payments, otherwise known as coupons. Instead, zero-coupon bondholders merely receive the face value of the bond when... Advantages and Risks of Zero Coupon Treasury Bonds Unique Risks of Zero-Coupon U.S. Treasury Bonds. Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall ... Zero-Coupon Bond - The Investors Book Definition: A zero-coupon bond, as the name suggests, it is a financial instrument which does not allow a regular interest payment to the investor.Moreover, it is a bond which is issued at a meagre market price (discounted price) in comparison to its face value. And it is redeemable on or after a specified maturity date at the par value itself.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ...

Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ...

Should I Invest in Zero Coupon Bonds? | The Motley Fool So, for instance, if you spent $750 on a 10-year $1,000 zero coupon bond, then the fact that the bond was priced to yield around 3% would mean that you'd have to pay tax on 3% of its value each ...

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond doesn't pay interest, but it could pay off for your portfolio. Choosing between the many different types of bonds may require a plan for your broader investments. A zero coupon bond often requires less money up front than other bonds. Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates.

Zero Coupon Bonds - Financial Edge Training Characteristics of Zero Coupon Bonds Returns for investors. Zero bonds trade at a discounted price, lower than the amount received at maturity. This difference between the traded price and redemption price is the return realized by investors over the bond's life. This amount is also known as the accreted interest. An example is a 10-year zero ...

Difference Between a Zero Coupon CD & a Bond - Zacks Both bonds and zero coupon certificates of deposit, or CDs, are debt securities, meaning the issuer of the bond or zero coupon CD promises to repay the investor the principal sum in addition to ...

Zero Coupon Bond在剑桥英语词典中的解释及翻译 zero coupon bond的意思、解释及翻译:a type of bond that does not pay interest, but that you buy for less than its face value , so that…。了解更多。

Numeraire: Money market vs zero coupon bond - QuantNet Community Q1: Money market account is an interest-bearing deposit account, it is simply an account such that a deposit at time s produces income M (s,t)=exp (int_ {s}^ {t} r (u) du) at time t. In the general case one allows r (u) to evolve according to some stochastic process, and in the simple case r (u) is constant. Q2: Normalized zero-coupon bond pays ...

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Figure 14.9 December 31, Year One—Interest on Zero-Coupon Bond at 6 Percent Rate 3. The compounding of this interest raises the principal by $1,068 from $17,800 to $18,868. The balances to be reported in the financial statements at the end of Year One are as follows: Year One—Interest Expense (Income Statement) $1,068.

How to Buy Zero Coupon Bonds | Finance - Zacks 2. Zero coupon bonds, also known as zeros, are distinct in that they do not make annual interest payments. The bonds are sold at a deep discount, and the principal plus accrued interest is paid at ...

Zero-Coupon Bond - Definition, How It Works, Formula Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest that will be earned over the 10-year life ...

Zero-Coupon Bond: Formula and Excel Calculator Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ...

/GettyImages-1169665828-e5e668e6aa454b60b5d06e110711eff3.jpg)

Post a Comment for "40 coupon vs zero coupon bonds"